What’s the Future of Real Estate…And Is It Time to Enter the Market?

If you’ve been following the residential housing market this last year, you know it’s been pretty crazy! Home values have been rising at an unprecedented rate.

Home prices over the last 18 months.

Home prices over the last 18 months.

It’s not one source of data making this claim either. From the House Price Index to the S. National Home Price Index to the Home Price Insights Report, year-over-year gains in home price appreciation were 18.8 percent, 18.6 percent, and 18 percent, respectively.

Homeowners in 2021 were all like…

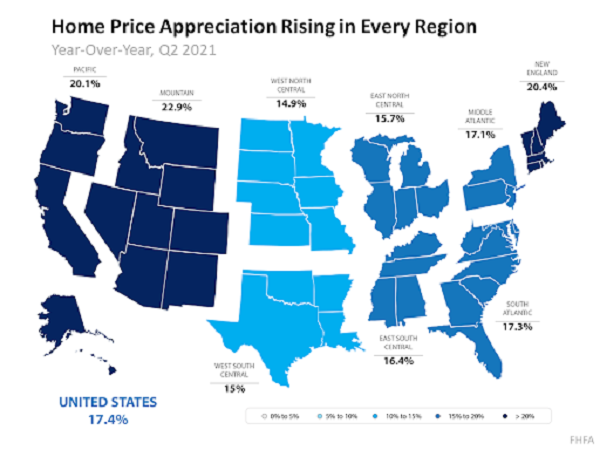

Think it’s one region skewing the numbers? Think certain homes are exempt from these gains? Nope. These dramatic numbers are seen across all US regions and homes at every price point.

Homes at All Price Points Are on the Rise

If you assume it’s just the mansions going up in value, think again. According to the latest Home Price Index, homes within every single price range are up at least 19 percent.

- Low Range: Up 22.1 percent

- Low-to-Middle Range: Up 20 percent

- Middle-to-Moderate Range: Up 19.9 percent

- High Range: Up 19.1 percent

Homes across the Entire United States Are Seeing Gains

On average, a home in the United States has appreciated by 17.4 percent from quarter two of 2020 to quarter two of 2021.

Here’s a breakdown of all the gains by region:

Image courtesy of a Federal Housing Finance Agency report.

Image courtesy of a Federal Housing Finance Agency report.

This puts the lowest year-over-year gains at 14.9 percent. To put that into perspective, this report states the median home price in the United States in the second quarter of 2021 was $374,900. A 14.9 percent increase represents an additional $55,860.10 in equity…over just one year of ownership!

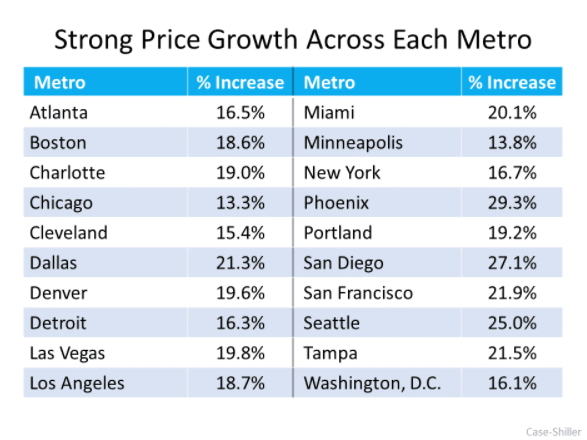

Even with fewer people moving to big cities in the wake of remote working opportunities, the top twenty US metropolitan areas still saw big home appreciation gains. The smallest gain for a major metro area was 13.3 percent (Chicago), and the largest was 29.3 percent (Phoenix).

See the full chart here:

Chart provided courtesy of the US National Home Price Index.

Chart provided courtesy of the US National Home Price Index.

Where Are Home Values Headed in 2022?

Lots of factors affect home value, but one of the biggest drivers is supply and demand. Single-family homes over the last year and a half have been in very strong demand. Supply, on the other hand, has been historically low. Those two things combined helped drive home values sky high.

Data shows there could be some relief on the way, though, for would-be home buyers. This report indicates 432,000 new homes hit the national housing market in August alone. That’s over 18,000 more than that time last year.

Will supply and demand completely level out by 2022? Not likely. CoreLogic has the following to say:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

(Want more details? Check out this article about the sellers’ market currently happening in Northern Virginia real estate.)

Given this anticipation of homes continuing to fall short of demand, most forecasts still predict at least moderate home appreciation over 2022. Here’s what the experts have to say:

- Home Price Expectation Survey: Up 5.12 percent

- Mortgage Bankers Association (MBA): Up 8.4 percent

- Freddie Mac: Up 5.3 percent

- Fannie Mae: Up 5.1 percent

- National Association of Realtors (NAR): Up 4.4 percent

While these predictions have home appreciation slowing from the historic gains of 2021, these numbers still surpass the annual average of the last twenty-five years: 4.1 percent.

So…Is It the Right Time to Buy?

No one has a crystal ball.

Ok. Some people have a crystal ball.

But one thing in the housing market is sure. Anyone who owned a house last year saw substantial equity gains, and by all predictions, those gains only look to increase over 2022.

If you’re considering entering this housing market, sooner could be better than later. The faster you close on your new real estate deal, the more time you have to capitalize on these forecasted increases in home appreciation.

Is it time to get off the fence and go for it?

Is it time to get off the fence and go for it?

The average mortgage is also less than the average rent now, so you’d actually be saving money every month—regardless of equity. (See this article for more information.)

Have questions? Ready to get started? Want to see real estate as it should be? Reach out today!