5 Factors That Indicate Real Estate Will Stay Hot Next Year

Thinking about buying or selling a home in 2022? Curious what the real estate market will look like? Here are five key factors that can help us determine what the market is going to do over the next year.

1. Demand Will Stay Strong

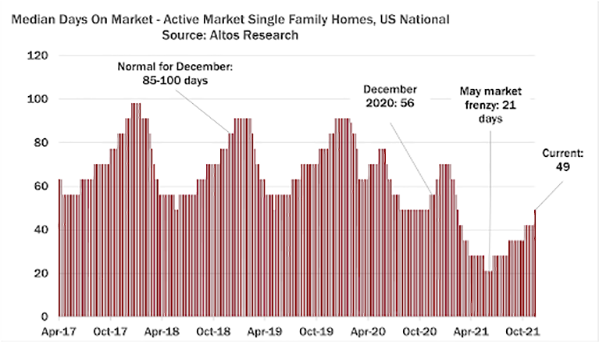

Days on market, or DOM, is one of the best indicators of demand. (The longer homes sit on the market, the less overall demand we can assume is at play.) So, how fast does the average home move right now?

Currently the median days on market is forty-nine and rising.

(All photos courtesy of Housing Wire)

This has a lot to do with the time of year. In a “typical” December, homes will sit anywhere from eighty-five to one hundred days. That means, compared to historical norms, demand is still much higher than average.

Based on today’s data, the projected DOM will be twenty-one by April. (That’s a tie for the record-breaking trends we saw earlier in 2021.)

2. “Immediate Sales” Aren’t Slowing Down

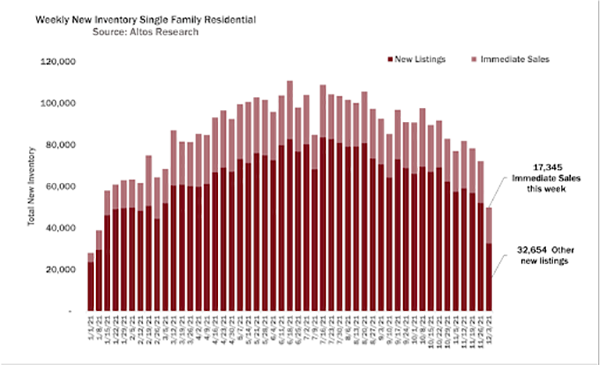

An immediate sale is largely what it sounds like. It’s any home that goes under contract within days, or even hours, of being listed.

If you’ve been trying to get a house in this market, you’re probably all too aware of this trend.

Home buyers.

Even as we’re seeing supply dwindle and overall transactions go down with that, immediate sales are still strong. Nearly one-quarter of all properties fall into this category.

Even throughout the holiday season, when all housing metrics tend to fall, immediate sales are still strong. This is a good indicator this demand will carry into 2022.

If there is a dip in the market, immediate sales will be one of the first metrics to drop. As interest rates creep upward, this will likely cool immediate sales, but it will take several months before rates hit a number that actively discourages buyers. Immediate sales, multiple offers, and bidding wars are all projected to continue into at least quarter two of 2022.

3. Price Reductions Are Down

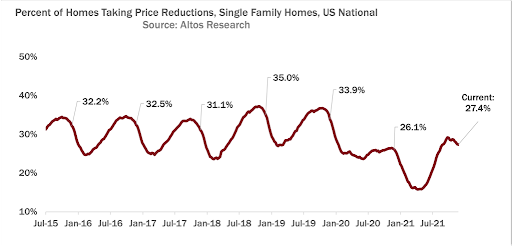

Currently, 27 percent of homes have taken a price reduction. In an average market, that number would be between 30 and 35 percent.

Because demand indicators are still so high, sellers are not inclined to lower their prices to accommodate buyers. This means homes, especially in the first quarter of 2022, are likely to still be priced favoring the seller.

4. Low Inventory Continues to Be the Headline

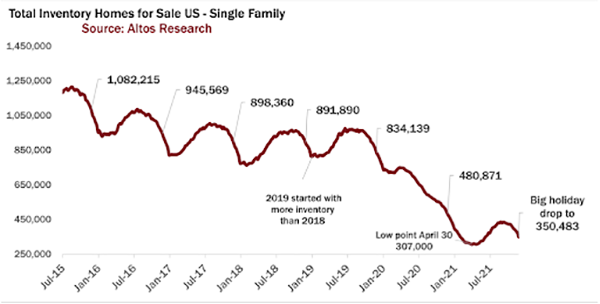

For all those eager buyers out there, the bad news is that inventory for single-family homes continues to hover at historic lows.

This downward trend has been happening steadily for years, and the rush of demand brought on by the pandemic has just made the situation even more challenging for buyers.

It’s worth watching interest rates, though. Even a marginal bump in interest rates could slow how quickly people are locking in mortgages and snatching up homes. If demand cools, it could give housing inventory time to accumulate and head toward a more “normal” curve in 2022.

5. Don’t Expect a Break on Home Prices

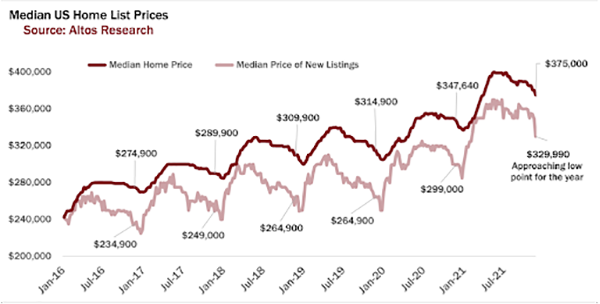

More good news for sellers! The median home price (for a single-family home) is currently at $375,000. That’s around 10 percent higher than this time last year.

The combination of low inventory, high demand, and fewer price reductions all point to home prices staying high into 2022.

There could be cooling effects on the market next year (increased interest rates, inflation, or other economic-related challenges), but the data isn’t available yet. If you’re thinking about selling your home, this could be the perfect time! (Unsure? Check out this breakdown on current homes for sale and multiple offers.)

Need help navigating this landscape as a buyer? Want to capitalize on this sellers’ market? Reach out today, and you’ll discover real estate as it should be!