Go Big…and Go Home!

Over the last year and a half, the real estate market has been turned on its head.

Good. Now transition gently into upside-down pandemic real estate market. And hold. Hold. Breathe and shake it out.

Good. Now transition gently into upside-down pandemic real estate market. And hold. Hold. Breathe and shake it out.

From remote working capabilities to still historically low mortgage rates, it’s the perfect recipe to finally upgrade into your dream home. Here’s why:

Remote Work Has Changed…Well, Almost Everything

One of the biggest drivers affecting the real estate market right now is the ability to work remotely. Even as vaccinations increase and the United States begins to open up slowly, more and more companies are agreeing to allow their employees to work from home indefinitely. (Here are just thirty companies that have already said yes to fully remote or hybrid work.)

What does that mean for home buyers and home sellers?

Space is at more of a premium than ever. With a home office being basically a necessity now, almost everyone is scrambling for homes with an extra bedroom or two. Or at least a floor plan that’s more conducive to home and work residing under the same roof.

“Why, yes, this is my bedroom, my living room, my home office, and where my children Zoom into school every day. And if I ever stop smiling, I just, you know, spontaneously burst into tears.”

“Why, yes, this is my bedroom, my living room, my home office, and where my children Zoom into school every day. And if I ever stop smiling, I just, you know, spontaneously burst into tears.”

Mortgage Rates Are Incredibly Low

Mortgage interest rates continue to be incredibly (record-breakingly) low. Whether you’re looking at the fixed thirty-year mortgage, the fifteen-year, or some other loan option, it’s never been more affordable to get into a home.

Say you want a mortgage in the amount of $1,000,000, and you want a fixed thirty-year rate. Compare these monthly payments just by fluctuating that interest rate:

- 2 percent: $3,696

- 3 percent: $4,216

- 4 percent: $4,774

By swinging the interest rate just two percentage points, you end up saving $1,078 per month. If you’re assuming what’s affordable for you based on old mortgage interest rates, it’s worth doing the math again, talking to a lender, or reaching out to a qualified Realtor.

Get Top Dollar for Your Current Home

Chances are the home you’re currently in has never been more desirable. Across the United States, inventory is low. Historically, frustratingly, bidding war–inducingly low. The market simply can’t keep up with the current buyer demand.

A barren wasteland with nothing as far as the horizon in all directions…aka most Zillow search results when looking for a 4/3 on a quarter acre.

A barren wasteland with nothing as far as the horizon in all directions…aka most Zillow search results when looking for a 4/3 on a quarter acre.

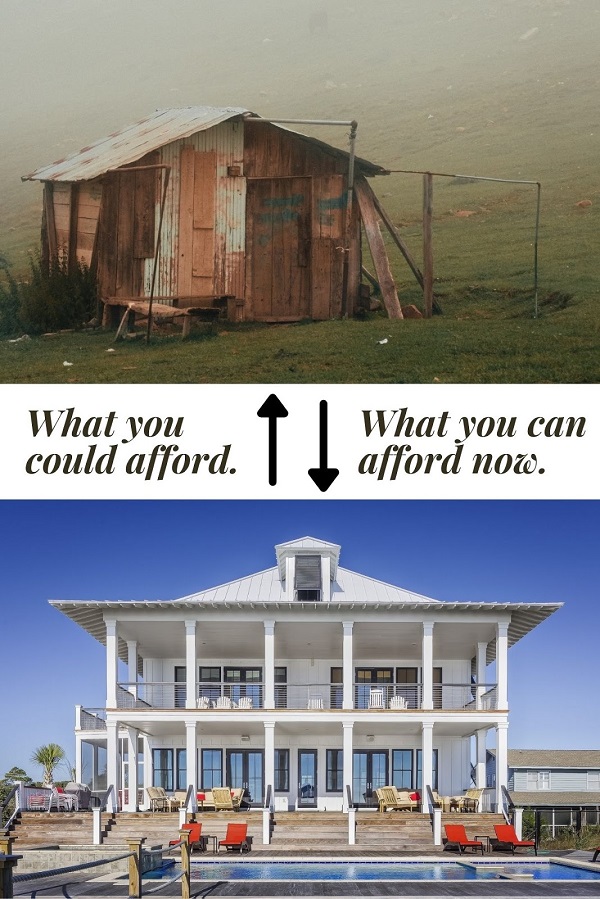

(Finally) Get into Your Dream Home

As a seller, this low inventory and high buyer demand make for terrific news. Here’s why it’s also great news if you’re looking to upgrade to a larger home.

- Those low interest rates can make homes with bigger price tags more affordable than you might think. Essentially, buying in the upper end of the market right now will yield more value than ever before.

- You can leverage the extra cash you get from your current home into a higher-priced home.

- You get the space you need for remote work. That guest room you’ve always wanted. A mother-in-law suite. Whatever suits your new set of needs.

- The upper end of the market is far less competitive than mid-market homes. According to Lawrence Yun, the chief economist for the National Association of Realtors (NAR), “The market is hot pretty much everywhere and across all price points…The only area where there is sufficient inventory is in $1 million-plus homes.”

- Big homes are still desirable, especially as affluent ex-urban workers move from high-density cities into more rural or suburban settings. According to the April Luxury Market Report (Institute for Luxury Home Marketing), “The analysis determined that there was a 17% increase in the number of 5,000+ sq ft homes sold [in 2020] when compared to the number of sales in 2019.”

Right, but does the square footage include the hedge maze or not?

Right, but does the square footage include the hedge maze or not?

Act Sooner Rather Than Later

Obviously, not everyone is in a financial position to purchase homes north of a million dollars. If you are, though, don’t hesitate. The circumstances that are making it such an ideal time to buy in the upper half of the market could change just as quickly and drastically as they did initially.

Interest rates could go up. Competition at this price point could increase as more people stretch to their upper financial limits. Even investor activity at this level could surge with the high current demand.

If you’re thinking about selling your current home and translating that into a larger investment, let’s connect. We have nearly four decades of experience working in these real estate markets, and we’d love to answer any questions you have and discuss what opportunities our local markets present for you. This is real estate as it should be!