How Homeownership Is Good for You and Your Wealth

Owning your own home brings with it many benefits. A sense of stability. The ability to paint those kitchen cabinets whatever color you like. A forever home for Fido—without the exorbitant pet rent.

Pretty please, can I stay for free?

Pretty please, can I stay for free?

One of the best things about homeownership, though? The financial benefit!

#1 Financial Benefit: Wealth Creation

As long as there has been a real estate market, homeownership has been the crucial first step towards creating household wealth.

“Homeownership has cemented its role as part of the American Dream, providing families with a place that is their own and an avenue for building wealth over time. This ‘wealth’ is built, in large part, through the creation of equity…Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

The American Dream. White picket fence optional.

The American Dream. White picket fence optional.

Essentially, every time you pay your mortgage, you’re building equity in your home. Compound that with how much your home’s value appreciates over time, and you’re looking at significant wealth creation that simply isn’t available to those who rent. This financial upside isn’t nominal either. It’s a major contributing driver to the realization of financial security.

“The wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is,” says First American Deputy Chief Economist Odeta Kushi. “For the majority of households that transition into homeownership, the most recent data reinforces that housing is one of the biggest positive drivers of wealth creation.”

Equity Is on the Rise

With recent global circumstances, home values are on the rise, meaning homeowners’ equity is gaining faster than ever before.

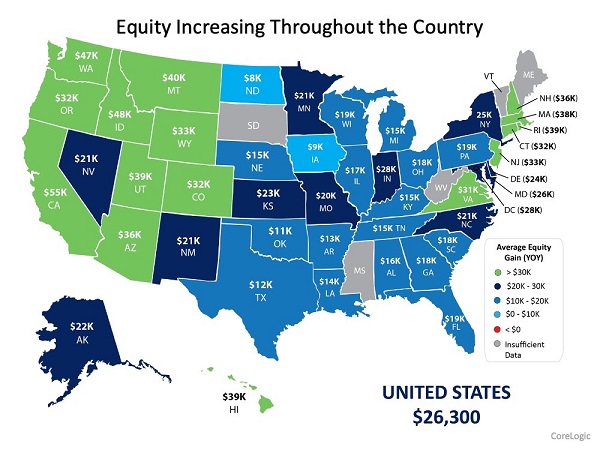

Check out this state-by-state breakdown of equity gains:

With insufficient data for Maine homeowners, we might never know how many extra lobster dinners they could enjoy with their equity gain.

With insufficient data for Maine homeowners, we might never know how many extra lobster dinners they could enjoy with their equity gain.

This increased equity is particularly helpful while navigating the challenges of the pandemic. It even brought an unexpected boon for all those who found themselves suddenly and unexpectedly in the remote workforce.

“This equity growth has enabled many families to finance home remodeling, such as adding an office or study, further contributing to last year’s record level in home improvement spending,” says Frank Nothaft, chief economist at CoreLogic.

First-Time Home Buyers Are on the Rise Too

It’s not just investors, moguls, and the already wealthy who have zeroed in on this correlation between homeownership and wealth. As home values shot up, those who might have otherwise waited to enter the market saw the financial incentive of taking the leap.

Frank Martell, president and CEO of CoreLogic, states, “This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake.”

Getting a piece of the cake is always good. Always.

Getting a piece of the cake is always good. Always.

Good for the Homeowner. Good for the Economy.

Increasing your net wealth through real estate also contributes to what is known as the “wealth effect.” Very simply, this is the behavioral theory that the more you have, the more you spend.

Whether you can imagine your parents scolding you every time you make a lavish purchase or not, there’s no doubt there are benefits for the economy.

I’m not mad. I’m just disappointed. And a little mad.

I’m not mad. I’m just disappointed. And a little mad.

A 2020 report from the Rosen Consulting Group outlined what exactly the wealth effect means for keeping the national financial wheels spinning.

“In economic literature, the wealth effect is a term used to describe the fact that individuals have a tendency to increase their spending habits when their actual or perceived wealth increases. For homeowners, the latent savings achieved by building equity in their home and the growth in home values over time both contribute to increased net worth. Through the wealth effect, this in turn translates to households having a greater ability and willingness to spend money across a wide range of other types of goods and services that spur business activity and provide a positive multiplier effect that creates jobs and income throughout the economy.”

5 Unbelievable Facts about Home Equity

A recent release from CoreLogic, the Homeowner Equity Insights Report, revealed five pretty astounding facts about home equity over the past twelve months.

- About 38 percent of all homes don’t have a mortgage.

- Mortgaged homes in the last year gained an average of $26,300 in equity.

- What’s the current average equity of a mortgaged home? Over $200,000!

- After the last year, total homeowner equity skyrocketed 16.9 percent.

- Total homeowner equity has now reached over…wait for it…$1.5 trillion!

If you’re ready to take the first step on the path to wealth generation, reach out. We can help you find the starter home that fits your budget, fits your lifestyle, and helps you take advantage of the power of equity!

Wondering if now is the time to sell and to capitalize on your home’s increased value? Here are five reasons there’s never been a better time than this spring to list.

Whether you’re buying or selling, with us, you get real estate as it should be!