How to Get into a Home in This Sellers’ Market

Are you a first-time home buyer who’s feeling overwhelmed in this competitive housing market? You’re not alone! Here are three first-time home buyer tips that can help:

1. Expand Your Search beyond Single-Family Homes

When many people think of owning a home, a yard and a white picket fence come to mind.

Especially in this competitive market, though, it’s important to remember homeownership can include a lot of different options:

- Single-family homes

- Condominiums (condos)

- Townhomes

While not everyone immediately thinks about buying condos or townhomes, they do offer some distinct advantages:

- Less competition. Because so many people prize the single-family home, there are often fewer people looking to get into condos and townhomes. This can ease some of the burden around more buyers than available homes on the market.

- Less expense. Especially for first-time home buyers, condos and townhomes are excellent options because they tend to be less expensive than single-family homes. Unlike a rental, though, you still get the advantages of building equity in something you own.

- Less maintenance. Condos often have homeowners associations that take care of communal spaces, landscaping, and even some small in-unit repairs. This can help reduce the financial and time-related burdens of homeownership.

Not sure if condo living is right for you? Here’s a breakdown of the pros and cons of buying a condo.

As a first-time home buyer, it’s easy to get priced out of the single-family home market—especially in today’s landscape. A condo can be a great entry into real estate and a way to build solid equity that eventually translates into a private detached home.

2. Don’t Let the Myth of 20 Percent Down Stop You

Want to know the most persistent—and harmful—myth in home buying? It’s that you need 20 percent down to purchase a home.

Here’s the truth. You don’t!

As a first-time home buyer, getting to that elusive 20 percent can feel really difficult, especially with the way home prices and inflation are headed. Given everything, it makes sense that 29 percent of first-time real estate buyers listed saving up for a down payment as the single biggest hurdle to homeownership.

If 20 percent is a myth, what does it actually take to successfully secure a loan and get into a home? Here’s how the numbers break down:

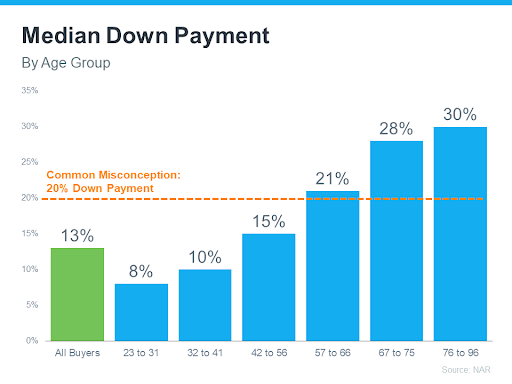

This graph shows the median down payment (across all age demographics) is just 13 percent. In fact, it doesn’t surpass that 20 percent mark until you’re dealing with buyers fifty-seven or older.

(Interested in all the data? Check out more insights into generational real estate trends.)

Many loans only require 3.5 percent down, and some specialty loans for qualified buyers can be as low as zero down. On top of that, there are also many down payment assistance programs to help. These are often targeted at specific groups, including active or former military, teachers, and (you guessed it!) first-time home buyers.

You. Learning about first-time home buyer assistance programs.

Are there advantages to putting down 20 percent? Yep, including getting out of private mortgage insurance and being able to put forward a more attractive offer. But if you’re thinking homeownership is off the table just because of the down payment, think again!

Curious how much you need to submit a serious, competitive home offer in this market? Talk to a qualified, experienced local real estate agent. He or she can give you more guidance about what’s necessary in your specific region.

3. A Real Estate Agent Is Your Best Friend through the Home-Buying Process

Speaking of Realtors…they are invaluable to first-time real estate buyers. The home-buying process can be tricky to navigate, especially if you’ve never done it before. Having an experienced professional in your corner can make all the difference.

If you’re not even sure where to start in the home-buying journey, make finding a great Realtor your first step.

He or she can provide a ton of value:

- Educate you on the process and what to expect

- Connect you with a lender suited to your situation

- Help you navigate mortgage preapproval

- Advise you on your local market (availability and affordability)

- Draft an offer that’s enticing to sellers

- Negotiate the transaction to get you the most for your money

Here’s the best part. Sellers are almost always responsible for covering the Realtors’ fees out of the home sale profits. That means, as a buyer, it costs you nothing to get all this insight, knowledge, help, and value!

Why Does Owning a Home Matter?

With interest rates on the rise and home prices skyrocketing, it has many people wondering if homeownership is financially out of reach. While homes have certainly become less affordable in recent years, that doesn’t mean they’re unaffordable.

If it’s feasible for you, homeownership is still an amazing way to enjoy freedoms you wouldn’t have as a renter…and to build your personal wealth.

Arm Yourself with Real Estate Knowledge

What’s the best way to have success in real estate? Learn!

Learn about the process. Learn about market trends. Learn about down payments and loan officers and traditional financing.

Learn…but realize you don’t have to be self-taught.

If you’re looking for a great teacher who can help you learn what you need to know about real estate, reach out today!

We can’t wait to show you real estate as it should be!