5 Reasons to Buy a Smaller House after Retirement

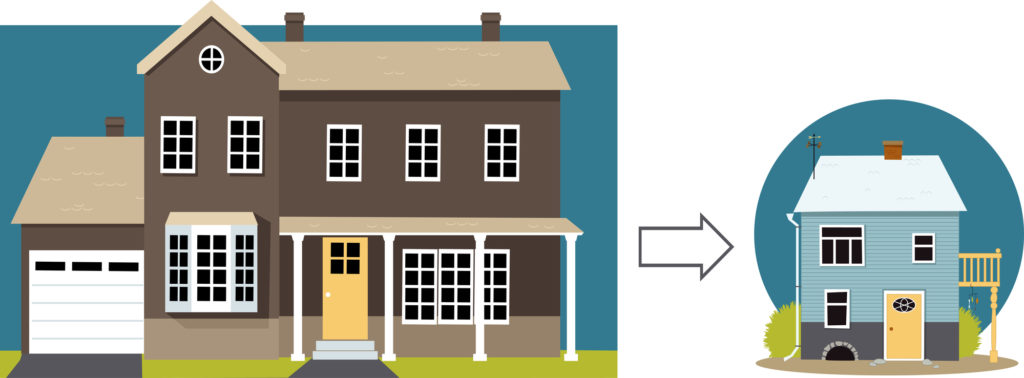

If you’ve recently retired, you’ve probably found yourself asking this question: Should I downsize my house? It’s a big decision, and downsizing isn’t right for everyone. For some recent retirees, though, it makes a lot of sense. Here are five compelling reasons to make the move to a smaller home:

1. Buy a Home That Matches Your New Needs and Lifestyle

With retirement comes a massive lifestyle adjustment.

Because so much about your day-to-day life is changing, what you need in a home will also likely change.

Maybe that means…

- Not worrying about a home office space anymore.

- Not being tied to a physical location near your place of work.

- Not needing so many bedrooms with children grown and moved out.

- Wanting to minimize the required maintenance around the home and property.

After retirement, you’ll need to assess what’s important to you and what you’re looking for in a home now. If your needs have changed, ensure your home matches those new needs. For many, that means downsizing to a smaller home.

2. Be Closer to Loved Ones

When you’re working, your home needs to be within a reasonable commute to your job. Even if you moved to remote or hybrid work over the last few years, you still need to be close enough that you’re available to come in when needed.

When you’re done working, you’re not bound by that anymore. You’re free to move closer to friends, relatives, children, or anything you want.

When many make this move, they choose to couple it with a significant downsize.

Remember, downsizing doesn’t just mean one thing. Any of these moves qualify as downsizing:

- Buying a smaller single-family home

- Pivoting from a single-family home to a condo or townhouse

- Buying a home with less property (and less associated maintenance)

3. Free Up Your Schedule (and Be Happier!)

Maintaining a home and property is no small feat. One study found the average homeowner spends 90 minutes every single day on basic household maintenance.

That time really adds up.

As people enter retirement, many want to dedicate their time to other pursuits. Maybe that’s exploring hobbies, traveling, spending more time with family, or even just relaxing.

Moving to a smaller home will free up more of your time, and you can dedicate more quality hours to whatever you want to pursue during your retirement.

There’s even evidence this can boost your overall happiness. One study published in Nature Neuroscience found a link between new, diverse experiences and environments and feelings of happiness.

4. Capitalize on Your Equity and Lower (or Even Eliminate!) Your Monthly Payments

With the recent surge in home values, there’s never been a better time to downsize.

According to the findings in the latest Homeowner Equity Insights report, the average US homeowner added about $55,300 in home equity over the last year.

Using the additional equity in your current home, you can transition to a smaller home and have one of two things happen:

One, you can end up with a significantly lower monthly payment. By putting your equity toward your down payment, your resulting loan (and monthly financial obligation) will be that much smaller.

Two, if you’ve earned significant equity in your home over the years, you might be able to buy a home outright without any financing at all. This eliminates your monthly mortgage payment.

Whether you’re in the first or second situation, you free up more of your finances. This puts you in a better position to pursue all the things you want during your retirement.

5. Make Your Offer Stand Out in a Competitive Market

There’s no doubt it’s a sellers’ market in Northern Virginia (and across the United States) right now.

With multiple bids and escalation clauses and home inspection waivers and bids that are tens of thousands over asking, it’s hard to get your offer noticed.

By translating your equity into an offer with a hefty amount down, you help yourself stand out in this historically competitive market.

And if you can make a full offer in cash, that’s sure to make a home seller do one of these:

Looking to Sell and to Buy a Home? Don’t Go It Alone!

Selling your existing home and buying a new one involves a lot of logistics and details. Making a misstep can have big financial consequences.

Make sure to lean on the expertise of a qualified, experienced local real estate agent as you navigate this process. (Not sure if a real estate agent is worth it? Here are 5 big reasons to work with a Realtor.)

If you have any questions or want to get this process started, reach out today. We’re always thrilled to show you real estate as it should be!