Are Homes Today Unaffordable…or Just Less Affordable?

Owning a home is an amazing way to build personal wealth. Over the last two years, however, more and more people are assuming homeownership is out of their financial reach. With skyrocketing home prices and inflation upping the cost of day-to-day living, many are asking: Can I afford a house? If you’re wondering the same thing, here are three factors that could help answer that question.

3 Pieces to the Home Affordability Puzzle

Housing affordability is dependent on these three factors:

1. Home Price

It might seem obvious, but one of the most important considerations for home affordability is the price of that home.

Now, it’s no surprise that home prices have been on the rise. Dramatically. From January 2021 to January 2022, nationwide home values increased by 19.1 percent.

What exactly does that kind of increase look like? A home that was $625,000 would now be just under $744,000.

These significant increases in asking price are driving much of the narrative around home affordability today.

2. Mortgage Rates

Mortgage rates are an often overlooked aspect of home affordability, but they play a big role. Many factors contribute to mortgage rates, and numerous layers of global uncertainty right now make it particularly difficult to predict where they’re headed.

Homeowners do know, however, that mortgage rates have been on the rise. In February of 2021, an average fixed-rate thirty-year mortgage was 2.81 percent. In February of 2022, that number jumped to 3.76 percent.

Let’s use our $625,000 house as an example again. With a 2.81 percent mortgage rate, your monthly payment (not including taxes and fees) would be $2,571. Jump that mortgage rate to 3.76 percent, and suddenly your monthly ask is $2,898. That’s a monthly difference of $327.

Increased mortgage rates do hurt home affordability, and they’re already up nearly an entire percentage point from this time last year.

3. Salaries and Income

The last major factor to consider is how much you earn. This will directly affect how much home you can afford.

This is where the good news lives. Wages and salaries in 2021 rose by 5 percent for private industry US workers.

This is the silver lining in the debate over housing affordability. This extra income helps to offset some of the costs associated with inflated asking prices and increased mortgage rates.

Can the Median Family Afford a Home?

Are homes less affordable than they were two years ago? Yes. But that doesn’t mean they’re unaffordable. That’s an important difference! And the data backs it up.

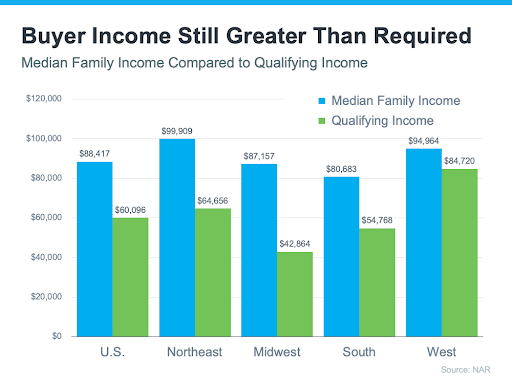

Across all sectors of the United States, the median family can still afford a home.

Across all sectors of the United States, the median family can still afford a home.

The current median household income across the United States is $88,417. The median income needed to qualify for a median-priced home is $60,096. That still gives many families a lot of leeway and the financial means to take on the monthly obligations of a mortgage.

In the Northeast, including areas like Northern Virginia and Maryland, families have even more room to play. Median salaries sit at just under $100,000, and median qualifying income is just south of $65,000.

Remember, these numbers are looking at large geographic regions. Always check your income against home prices in your specific location to determine affordability.

House Affordability…Why Does It Matter?

Given the financial and personal benefits of homeownership, it’s important to know if you can afford to jump into real estate. Simply assuming you don’t have the financial means to own a home could be dramatically hamstringing your personal wealth.

Don’t think buying a home makes that big of a difference? Take a look at the difference in net worth between a homeowner and a renter. In 2019, US homeowners had a median net worth of $255,000. Renters? Just $6,300.

With home prices and mortgage rates both projected to continue rising throughout 2022, anyone seriously thinking about entering the housing market should consider doing so sooner rather than later.

Remember, if home prices do rise, this will mean equity in your pocket rather than an ever bigger financial ask when you do decide to buy.

Can You Afford a House? Let’s Find Out Together!

Not sure if you can afford a house? Think you can but don’t know how much home you can afford? Reach out today!

We can talk you through local pricing, help you navigate national mortgage rates, and put you in touch with a lender who can work with your circumstances.

Let’s start the conversation, and you’ll discover real estate as it should be!