Will It Stay a Strong Sellers’ Market This Year or Swing in Favor of Buyers?

Wondering what home prices will do this year?

You’re not alone! Here’s what the experts have to say:

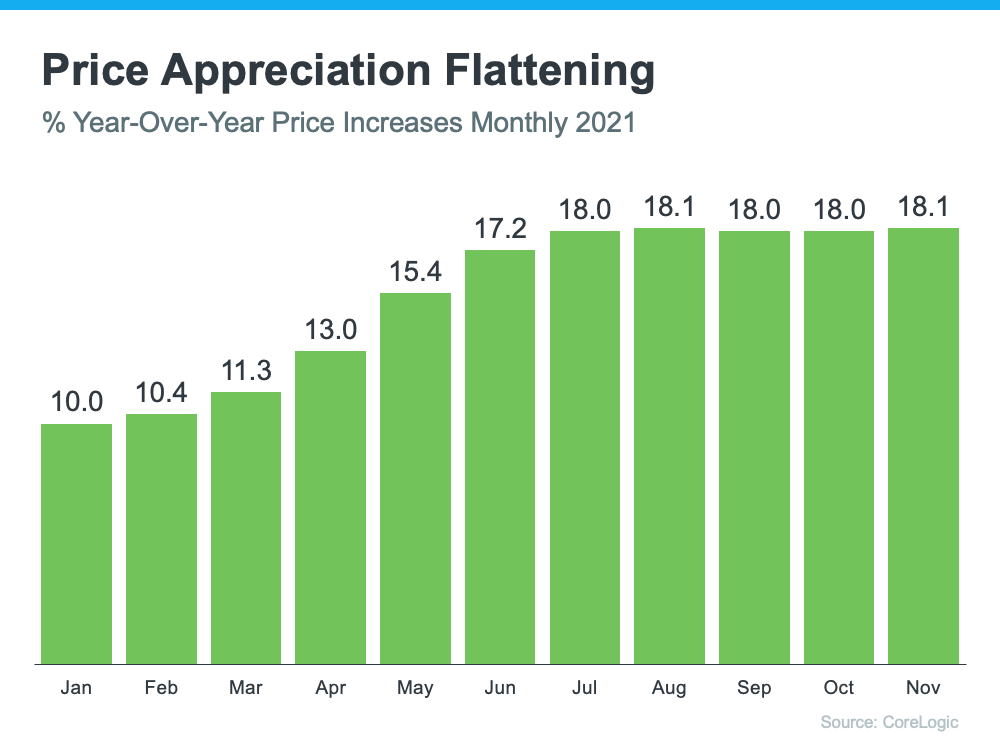

Home Appreciation Is Plateauing…but Not Dipping

The last two years in real estate have been…unusual, to say the least. During that time, we’ve seen an unprecedented increase in year-over-year home prices.

All images courtesy of https://www.mykcm.com/2022/01/13/whats-going-to-happen-with-home-prices-this-year/.

As the chart shows, double-digit year-over-year increases have become the norm.

Homeowners for the last two years.

While there was much conjecture that home price appreciation would come down, or at least decelerate, all we’ve really seen is a plateauing around 18 percent for the last five months.

Both the S&P Case-Shiller Price Index and the FHFA Price Index indicate continued price growth. Both sources also indicate this won’t be limited to a few geographical regions but will happen across the nation.

According to the FHFA, all nine regions throughout the country saw this double-digit appreciation, and the Case-Shiller 20-City Index shows the same for all twenty metro areas.

Why Didn’t Home Appreciation Fall Like Experts Thought?

You right now.

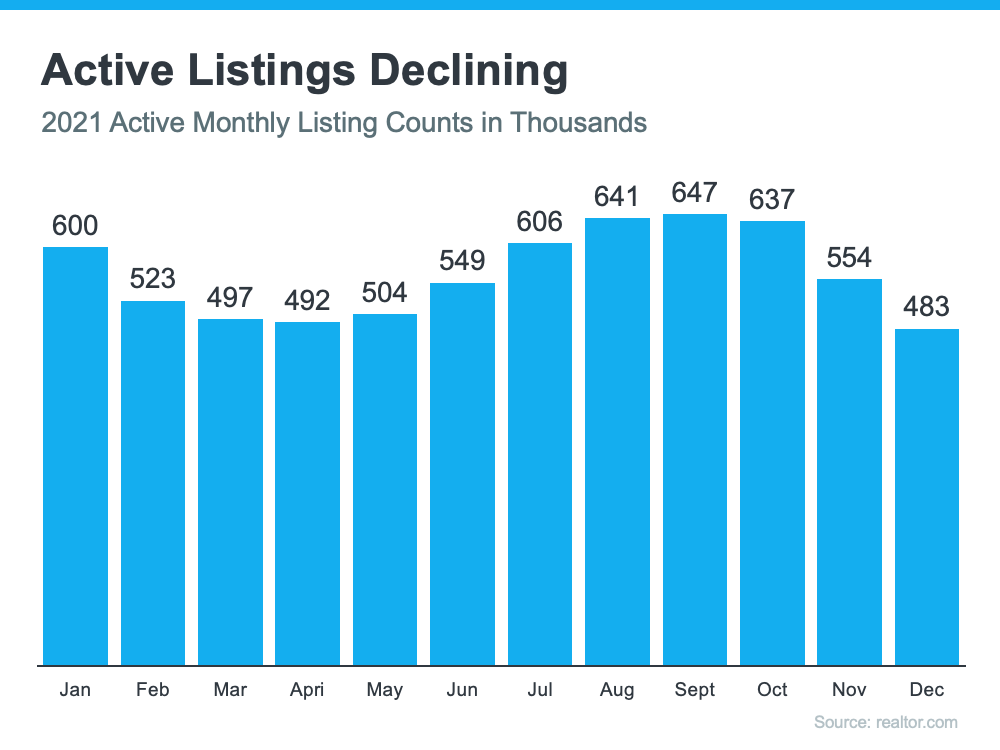

So, why were experts off on their predictions? It has a lot to do with supply and demand.

Experts thought a slew of homes would be put up on the market in the last half of 2021 and into early 2022. That hasn’t materialized as anticipated.

Why is this? A couple of factors could be at play.

1. Fewer Foreclosures

As forbearance programs came to a close, many anticipated a wave of foreclosures. For a number of key reasons, this never happened.

For one, the amount of equity people have in their homes has skyrocketed over the last few years. If someone was suddenly unable to make the mortgage payments, selling the home (rather than foreclosing) is a much more appealing option. This differs significantly from 2018, when home values collapsed, and selling was not a viable alternative.

2. Supply Chain Issues

Supply chain issues. (Ugh. If we never heard this phrase again, we’d be OK with that!)

Sick of the phrase or not, they have contributed to a slowdown in new constructions that would have added some much-needed inventory to the market.

3. The Pandemic

When tensions, concern, and uncertainty over the pandemic eased, experts thought available homes would start flooding the market. And that was starting to happen.

According to one report about the housing market and the pandemic, “Before the omicron variant of COVID-19 appeared on the scene, the 2021 housing market was rebounding healthily from previous waves of the pandemic and turned downright bullish as the end of the year approached.”

Then Omicron hit in November. With it came back many of the same concerns as the original strains, and new listings took a dip in December.

Whether that simply coincided with the usual lull around the holidays is unclear.

Key Takeaways

What is clear is this: Without the extra homes to tip the balance (even a little bit) toward buyers, it has remained a strong sellers’ market. In a world of low inventory, demand is high, and that continues to drive prices upward.

While home appreciation could slow down, or potentially even decelerate, throughout this year, the current supply and demand dynamic indicates this will not happen quickly or dramatically.

Want More Information?

Want a more high-level view of the real estate market in the New Year?

Check out five key factors that are affecting the current real estate landscape.

Have questions? Ready to buy or to sell your home? Contact us today. We’ve been operating in the Washington, DC; Virginia; and Maryland markets for nearly four decades, and we’re happy to show you real estate as it should be!