Should You Play the Stock Market or Invest in a Home?

Every financial advisor will tell you the same thing. When it comes to investing, risk is inevitably involved. Nothing is guaranteed, and there’s always the chance of losing hard-earned money. Given this, you want to invest as wisely and safely as possible, and for an astounding 93 percent of Americans, when given the choice between buying a home or stocks, the answer is…home!

The last time 93% of people agreed on anything.

The last time 93% of people agreed on anything.

This consensus shouldn’t be shocking. The Federal Reserve recently released a survey of consumer finances, and it revealed something most people already assume: you are financially better off buying a home than continuing to rent. What was surprising about the findings was just how much better off you are. The report found the average homeowner has a net worth that’s forty times greater than that of a renter.

That alone should be evidence enough that homeownership is a worthwhile investment.

Would you rather have one of these or forty? Exactly.

Would you rather have one of these or forty? Exactly.

Stock Market or Housing Market?

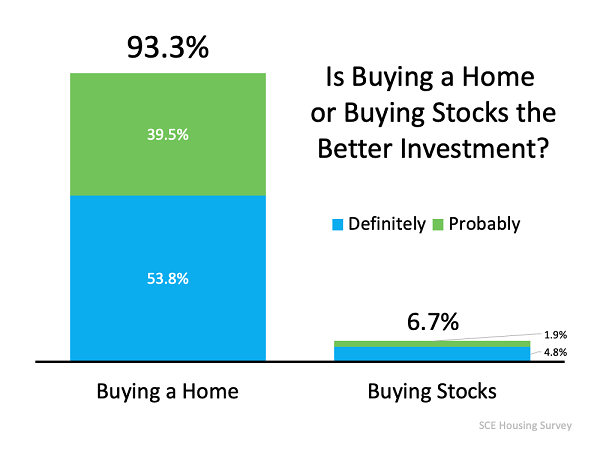

In another study discussed on this blog, the Federal Reserve Bank of New York found that 93.3 percent of American would categorize buying a home as “definitely” or “probably” a better financial move than investing in the stock market.

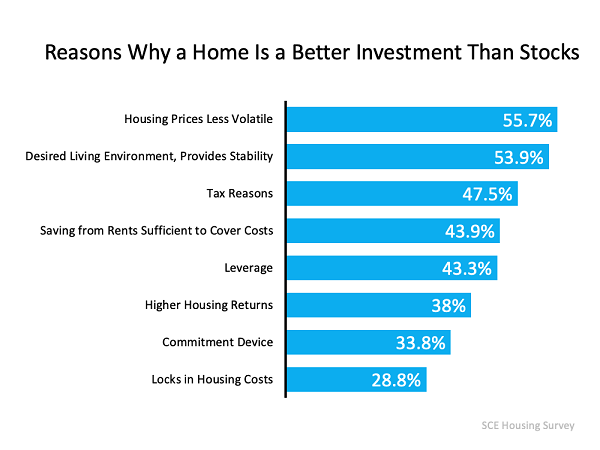

The reasons for this sentiment were varied. Respondents were allowed to select multiple answers, and here’s how the results broke down:

The reasons for this sentiment were varied. Respondents were allowed to select multiple answers, and here’s how the results broke down:

While the reasons spanned everything from stock market volatility to tax breaks for homeowners, the data strongly points to Americans believing money invested in real estate is a sound, smart, safe financial move.

While the reasons spanned everything from stock market volatility to tax breaks for homeowners, the data strongly points to Americans believing money invested in real estate is a sound, smart, safe financial move.

As is often the case, this overwhelming consensus was born from firsthand experience. Homeowners have seen their wealth grow over time, and renters have seen it stagnate. As the Liberty Street Economics blog notes, “Housing represents the largest asset owned by most households and is a major means of wealth accumulation, particularly for the middle class.”

The correlation between personal wealth and homeownership definitely becomes stronger the longer you own a property. This is because you both capitalize on home appreciation and increase your equity in the house. Not sure if renting or buying makes sense for you in the short term? Check out our free, quick rent versus buy calculator.

Did your results show it makes more sense to buy? Definitely reach out today! We’d love to talk through your options, helping you find the home that’s a dream for you…and your wallet. This is real estate as it should be.