Before You Panic about the Real Estate Market, Read This…

If it looks like a duck, swims like a duck, and quacks like a duck, then it’s probably a duck.

So, what kind of duck is supposedly waddling around in the real estate world? If you’re to believe recent headlines, we’re on the brink of a new housing crisis a la the infamous 2008 housing crash. A very scary duck indeed.

Today’s real estate headlines say we’re knocking on the devil’s door again. But is this really the case?

Our apologies to duck lovers for associating these little guys with the 2008 housing crisis.

Our apologies to duck lovers for associating these little guys with the 2008 housing crisis.

Why do some believe real estate will experience a second downturn? The events leading up to the housing crash of 2008 do seem to parallel today’s circumstances. There’s particular concern about the availability of low down payment loans, as well as down payment assistance programs.

For people who remember the 2008 crash, the “good news” of more readily available mortgages can seem like a wolf in sheep’s clothing.

Are you seriously trying to involve us too?

Are you seriously trying to involve us too?

Before you make up your mind, let’s break this all down…

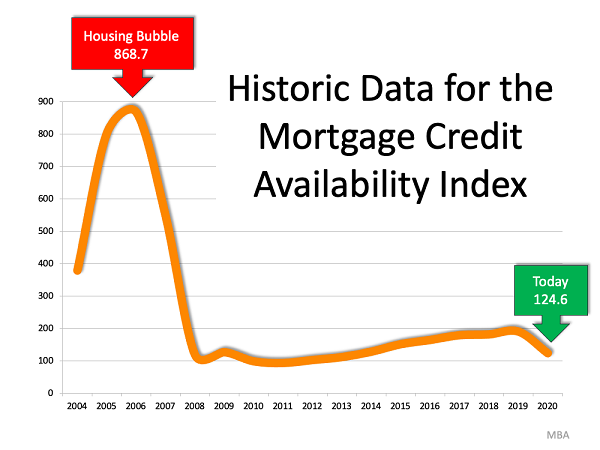

The Mortgage Bankers Association releases an index called the Mortgage Credit Availability Index (MCAI). This comes out several times a year. The Mortgage Bankers Association website offers some context:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit…The MCAI [is] a summary measure which indicates the availability of mortgage credit at a point in time.”

Essentially, this resource indicates whether a person can easily secure a mortgage. If the index is high, mortgage credit is more readily available. If it’s low, mortgages are more difficult to come by.

Data for this index first became available in 2004. This graph, therefore, represents the entire history of the MCAI:

In 2004, the index was about 400. As the housing market continued to thrive, mortgage credit became more and more available. By 2006, the index had soared past 850.

The subsequent real estate market crash two years later took the MCAI down with it. Mortgage money became extremely difficult to secure, and the MCAI was at an all-time low of below 100. Lending practices have been overhauled since then. Today, the index sits at 124.6. (For context, that’s nearly one-seventh of what it was at its peak in 2006.)

What caused the index spike during the housing bubble?

That precipitous spike is indicative of just how ridiculously easy it was to get a loan at that time and how dangerously weak lending standards were. Mortgage demand in 2006 was sky high, leading many mortgage lenders to offer loans to borrowers who would never qualify today. Lenders were approving loans so quickly and indiscriminately it was as if the borrowers were daring them to.

“Bro, I had to approve their loan. They dared me.”

“Bro, I had to approve their loan. They dared me.”

Many of these offered loans started with an attractively low rate, but that rate increased over the life of the loan. People lured by the initial rates didn’t always anticipate the built-in mechanisms that increased their financial obligations down the road.

The rest is history.

The painful lesson affected millions, and the aftermath still haunts the real estate ethos today.

Thankfully, lending standards have dramatically improved, getting stricter and smarter. As Investopedia explains:

“In the aftermath of the crisis, the U.S. government issued new regulations to improve standard lending practices across the credit market, which included tightening the requirements for granting loans.”

The result? Those highly risky loans that were so prevalent in 2006 are very rare today.

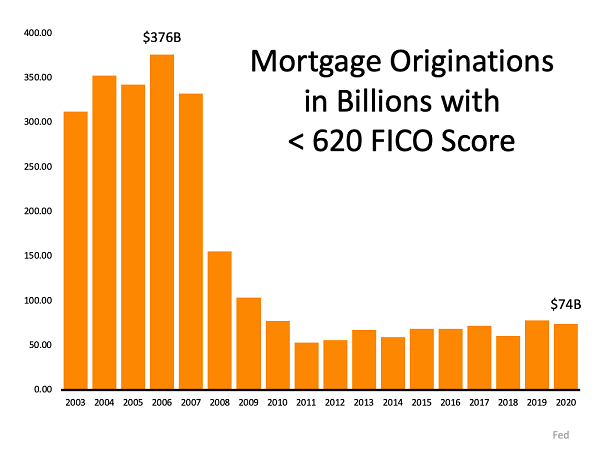

When examining conditions that led to the 2008 crash, one illuminating factor is FICO® credit scores. Unfamiliar with FICO® scores? The myFICO website explains:

“A credit score tells lenders about your creditworthiness (how likely you are to pay back a loan based on your credit history). It is calculated using the information in your credit reports. FICO® Scores are the standard for credit scores—used by 90% of top lenders.”

In the middle of the housing boom, borrowers with FICO scores under 620 were regularly being approved. Today, lenders are much more cautious about working with a borrower who has a lower credit score.

According to Experian, “Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future…Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range.”

That’s not to say there are zero loan programs today that allow for a 620 score or below. Borrowers in that range, however, should be aware that lending institutions today are much more cautious about approving their loan applications. Ellie Mae’s most recent Origination Insight Report reveals 753 was the average FICO® score on all loans originated in February 2021.

This graph reveals (in billions of dollars) how much mortgage money was given each year to borrowers with credit scores of 620 or lower.

Anyone worried about another housing crisis should take a quick glance at this chart. Check out the now-infamous 2006. Mortgage lenders allowed $376 billion in loans for borrowers with scores 620 or below. In 2020, that number was $74 billion, or more than five times less.

We congratulate you on staying up to date on your headlines, but those clickable links warning about another crash seem, for the time being, not likely to come to anything.

“That’s a relief. I assume the job market for recent graduates won’t be affected by the Coronavirus either. Guys? Hello?”

“That’s a relief. I assume the job market for recent graduates won’t be affected by the Coronavirus either. Guys? Hello?”

The main takeaway here is that today’s lending market and the lending market of 2006 are incredibly different. Before the 2008 crash, lending standards did not adequately take into account a borrower’s likelihood of paying back that loan. In response to those catastrophic practices (that both lenders and borrowers are still suffering from today), lending standards now are much stricter and more responsible.

While the headlines can seem alarming, it’s important to take the entire picture into account before making any decisions. Have questions about the health of today’s real estate market? Check out this article about our 2020 predictions, as well as this other cautionary piece about reading beyond real estate headlines.

If you have questions about whether you should buy, sell, or stay out of the market altogether, feel free to reach out. We’re always happy to help. With Ray Gernhart and Associates, we’ll give you honest, helpful advice and insight. Welcome to real estate as it should be!