Why Homeownership Is More Affordable Than You Think

At some point, there’s a good chance your friends or relatives have shared an article or video with you featuring a really catchy headline.

- Dog Finds Hidden Treasure!

- Lottery Winner Dumps $200,000 Worth of Mayonnaise on Ex-Boss’s Lawn

- It’s the Worst Time to Buy a Home!

Unfortunately, some headlines are just designed to garner more clicks, not to educate or to inform.

Whether that dog really found hidden treasure or that lottery winner fulfilled a very specific dream, sensationalized headlines can influence our outlook before reading the full story.

Especially when it comes to buying or selling a home, which is a huge life decision, it’s important to read beyond these headlines. To make the best move, you must know all the facts about what’s going on and how those factors will affect your financial situation.

If you’ve been reading the real estate headlines lately, you’ve probably come across claims about how housing is unaffordable for most Americans. The ramifications of the pandemic are largely fueling this popular misconception. These doom-and-gloom headlines are common nowadays, and they’re creating stress about something that is completely not true.

“Honey, are you sure they said we should move to Siberia?”

“Honey, are you sure they said we should move to Siberia?”

In reality, hard evidence indicates owning a home is still more affordable than renting in most parts of the country, and record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment twenty years ago.

The sea of misleading headlines obscures this truth. As people scroll quickly on their phones, they don’t always read the time-consuming articles, instead just quickly glancing at the headlines.

Despite these trending, attention-grabbing headlines, the cost of renting is still relatively high compared to the cost of home ownership, and declining interest rates are having a notable impact on the housing market and homeownership. This is especially true for most homes in suburban and rural areas.

“Let’s read the whole article before packing next time.”

“Let’s read the whole article before packing next time.”

Despite the facts, misleading headlines persist, and they impact how hopeful home buyers perceive the market. This incomplete information can negatively affect home buyers’ experiences or, worse, their real estate opportunities.

This Realtor.com survey indicates home shoppers were surprised by what they could actually afford when buying their first homes. In fact, 47 percent discovered their budgets were larger than they expected.

I guess I will be adding that basement bowling alley…

I guess I will be adding that basement bowling alley…

George Ratiu, senior economist at Realtor.com, explains.

“For first-time buyers, especially, the drop in the 30-year mortgage rate…has provided unexpected leverage. Lower rates allowed many buyers to stretch and buy more expensive homes while keeping their monthly budget the same.”

So, why do these negative headlines that cast doubt on affordability continue to exist?

Inaccurate headlines continue to trend because they’re not entirely false.

Most analysts only look at two of the three elements that make up the affordability equation: price and income. Yes, incomes haven’t kept up with house prices. However, affordability is about the cost of the home, not just the price. For that reason, mortgage rates, the third element of the affordability equation, are important to consider.

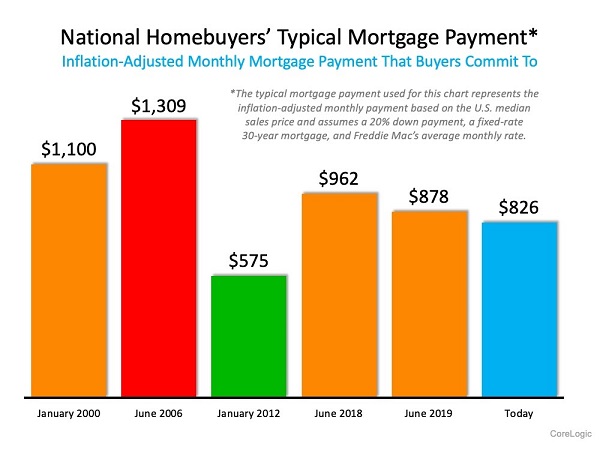

For example, here’s the typical mortgage payment for assorted dates going back to 2000, as calculated by CoreLogic:

Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today than any time in the last twenty years. You just have to consider all three elements of the affordability equation: price, income, and mortgage rates.

Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today than any time in the last twenty years. You just have to consider all three elements of the affordability equation: price, income, and mortgage rates.

Whether you’re a first-time buyer or an experienced buyer, it’s important to recognize dramatic headlines for what they are: dramatic. Headlines play into the drama of doubts, fear, and shock. The most reasonable action to take when researching homes? Stick to the facts.

Don’t let the headlines scare you away from your dream of homeownership. Instead, connect with real estate professionals to help you determine what you can afford and what’s available at that price.

Looking to jump into the market? Curious how much home you could afford? Reach out today. At Ray Gernhart and Associates, it’s our pleasure to talk through your options and get you into your ideal home. Work with us, and you’ll discover real estate as it should be! Like almost half of the buyers in the survey, you might be pleasantly surprised at what you can afford!